2021-07-03

Even if we encounter an unprecedented stock shortage in 2020-2021, the development of the semiconductor industry still has its cyclical nature. At present, the focus of widespread concern in the industry is when this wave of shortages will end and when the supply will return to normal. Multiple sources of information indicate that the entire semiconductor shortage market will not last long, but the shortage of individual chips will continue for some time.

Looking at the development of Chinese semiconductors, whether it is IC design or foundry, the pace has been significantly faster than before, but there are also many "heart-stitching" data telling us that China's semiconductors are actually still very weak, and the market share of many types of chips Very low, it is estimated that the market share of 10% will not be reached within ten years.

Recently, Sheng Linghai, vice president of research at Gartner, accepted an interview with the media including e-enthusiast. He analyzed the current status and trends of global semiconductor development in detail, as well as interpreted recent hot topics.

The current chip is out of stock, caused by accidental superposition of inevitable factors

Recently, the entire semiconductor industry has experienced the most serious shortage in 20 years. Sheng Linghai believes that the reasons for the shortage are mainly accidental and inevitable factors.

Accidental factors are the past Sino-US trade frictions, Huawei's stockpiling, and the closure of some factories. Among them, the Sino-US trade disputes caused some domestic companies to stock up a lot. After the market is out of stock, many large companies have also increased their inventory requirements, which has caused the overall demand to greatly exceed the available production capacity.

The inevitable factor is that in the entire semiconductor development, there will be a cycle in about two to three years, and it is currently in a peak cycle where supply exceeds demand. In 2019, there is actually an oversupply, which is also the point in time when the entire semiconductor market is declining. Push it two more years forward, and 2017 will be a peak. Often semiconductor companies will make a lot of investment during peak periods, and an oversupply situation occurs after two years of investment output.

During the "oversupply" week, that is, in 2019 and the first half of 2020, considering the impact of the new crown epidemic, many semiconductor companies have reduced or even delayed their investment. Therefore, from the perspective of the entire investment cycle, the current increase in production capacity in 2021 is actually the result of the investment in the previous two years. Due to the lack of increased production capacity, the current 5G mobile phones and the now declining Bitcoin demand in the first half of the year, the needs of notebooks, servers, and data centers caused by the new crown epidemic cannot be met.

It is expected that this time period will be delayed to the second quarter of next year. In the future, according to changes, Gartner will also adjust its forecast.

Global semiconductor market: 12-inch capacity increase is mainly 5nm and below, 55nm/65nm

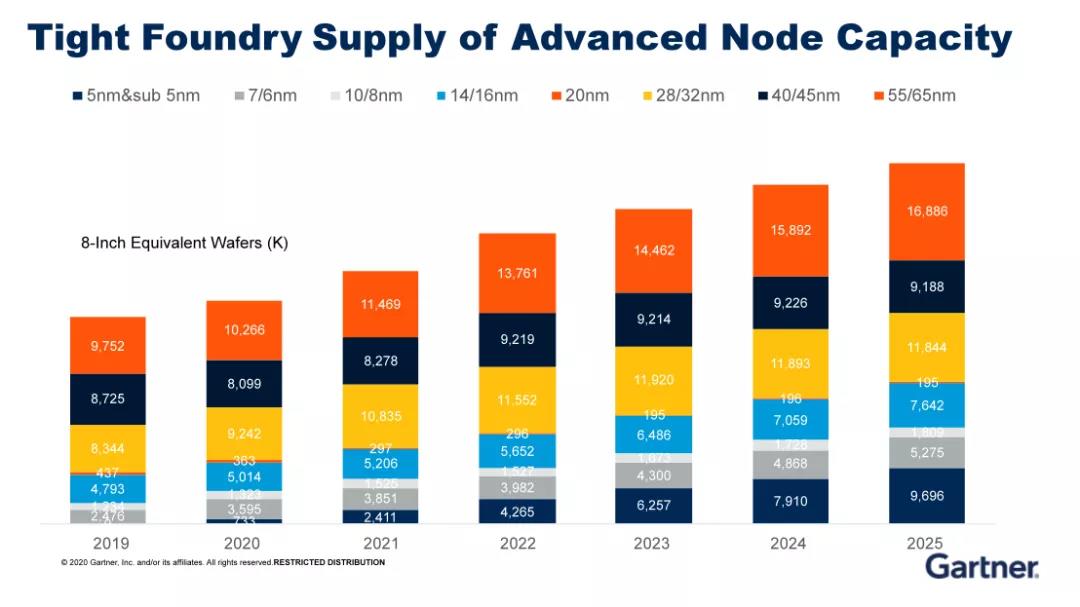

Based on the entire global semiconductor industry, Gartner has made the following predictions for 12-inch advanced process capacity.

It can be seen from the forecast that the largest increase in production capacity is 5nm and below. The upgraded version of 5nm this year, 4nm will also appear, next year's goal is 3nm. The increase in 5nm production capacity will promote the growth of the advanced process market.

It can also be seen from this picture that 55nm/65nm will also be a relatively large growth process. The main reason is that the current demand for 55nm is very large. Although 55nm is an older process, its demand will still increase significantly in the next few years. In addition, 28nm, 14nm, and 16nm all have greater opportunities for increase.

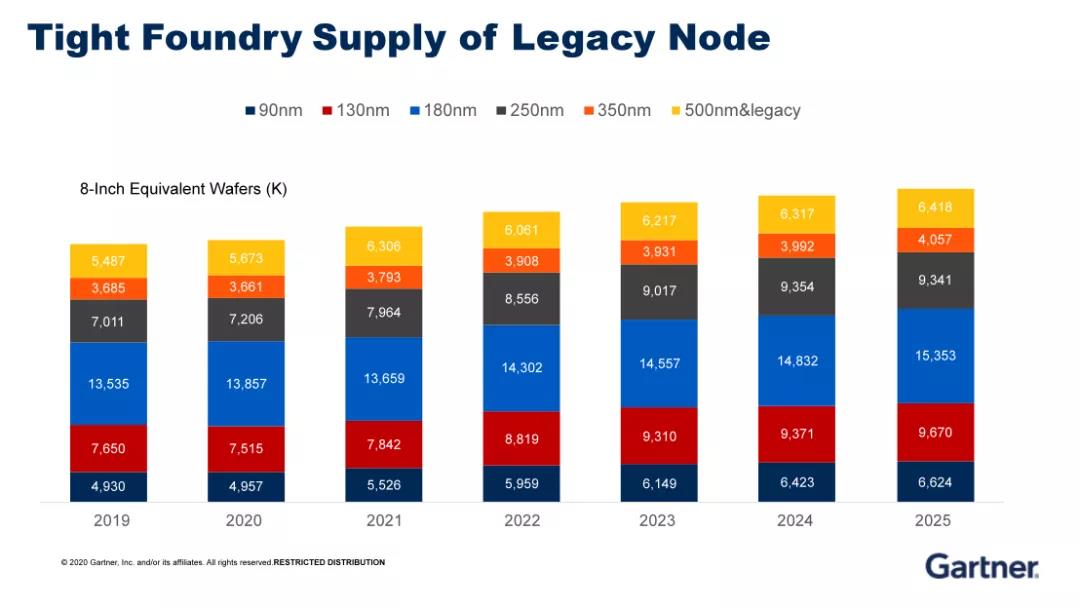

The traditional manufacturing process is concentrated on 8-inch wafers, which is most in short supply, but the investment in new plants is insufficient and the main focus is on expansion

In terms of traditional manufacturing processes, most of them are concentrated on 8-inch wafers, but 8-inch wafers are now in short supply. According to Sheng Linghai's analysis, due to the overcapacity of 8 inches in the past many years, the price has been "felling endlessly", and the trough period was only about US$300. Many factories, especially some semiconductor companies in Japan, have closed 8-inch production lines. At the same time, 5G mobile phones have a relatively large increase in demand for PMIC and analog circuits. Especially PMIC, its manufacturing process is concentrated in 180/150nm, mainly 8 inches and a small part of 12 inches, there will be no significant improvement. The increase in demand has immediately led to a very serious shortage of Power-related devices.

At present, there is no investment in a new plant for the 8-inch production line, and most of the investment is for expansion. For example, SMIC’s financial report shows that it will increase production by approximately 45,000 units. The expansion of production is actually to meet the increasing urgent demand, but to completely solve the problem of the shortage of 8-inch manufacturing process, it is still necessary to shift the 8-inch production capacity to 12-inch. Because the 12-inch capacity has a large output, its output can reach more than 2 times under the same time conditions. For example, Taiwan Power Semiconductor Manufacturing Co. is already using 12-inch wafers to produce PMIC power products for MediaTek. In addition, in addition to TSMC, Hua Hong Hongli is also doing BCD power-related processes on 12-inch wafers.

Sheng Linghai said that global semiconductor investment will have a greater leap this year. In the past few years, 2019 has been a downward trend. Due to shortages and shortages, there will be a substantial increase of more than 20% in 2021. These growths are mainly reflected in the advanced manufacturing process, as well as the current shortage of 28nm.

In addition, in terms of memory chips, especially NAND Flash, there will be a relatively large increase, while the situation of DRAM is slightly better because DRAM manufacturers have relatively conservative investments in order to control the high prices of the entire market. However, the demand for NAND Flash has been increasing, so the main investment should be in advanced manufacturing processes and NAND Flash.

At the same time, some domestic semiconductor companies are moving to 12 inches, producing products below 90nm or below 55nm. For example, Jinghe in Hefei and Yuexin in Guangzhou are all making such attempts.

It is estimated that by 2025, Chinese semiconductor companies will break through to 30% of the domestic market share

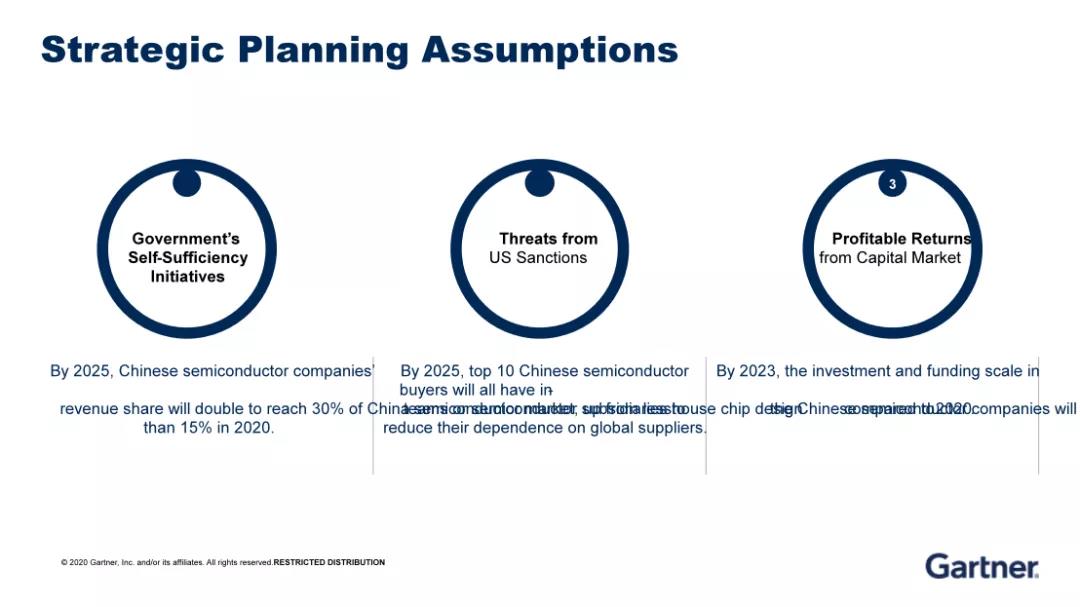

In fact, China began to put a lot of effort in semiconductor liberalization five years ago, and Gartner also made a series of predictions on the status quo of the Chinese market.

First of all, it is estimated that in 2025, Chinese semiconductor companies have the opportunity to break through from the current 15% share to 30% in the domestic market.

Sheng Linghai analyzed that there are many voices who believe that this share may be less than 10%. In fact, "less than 10%" is also correct, because some foreign foundry products produced in China will basically not use domestic chips, but use overseas chips. From this point of view, the prediction of less than 10% is the same. There are traces to follow. However, considering the domestic ownership, the proportion of domestic chips used by China's domestic electronics companies is also increasing. In fact, domestic semiconductor companies in the first half of this year encountered a rare opportunity for shortages and made great progress. Many companies have obtained more growth opportunities, and they have also obtained some opportunities in overseas customer expansion.

The second prediction is that the top ten Chinese semiconductor buyers are basically electronics manufacturing companies, OEMs or ODMs. The top ten electronic product manufacturing companies all have independent chip design capabilities. For example, OPPO, Xiaomi, Midea, and even Baidu, Alibaba and other companies are already building their own teams. The main benefit of establishing your own design team is that after a certain magnitude of scale is formed, procurement costs can be reduced. In addition, companies can also develop their own independent technologies and make differentiated and proprietary technologies and products.

The challenges faced include: whether the company can achieve this level of magnitude, as well as product design capabilities, and whether the overall price/performance ratio can meet the demand. At the moment, most companies are in the "burning" stage at the initial stage, and development is relatively difficult. So Gartner predicts that large companies will be more active because they are in a better financial situation, and large companies and investing in semiconductors in the domestic environment often receive government subsidies or other support.

The third prediction is about the scale of investment in China's semiconductor market. It can be seen that investment in the semiconductor industry has grown rapidly in recent years. Gartner predicts that China's overall investment scale in 2023 will increase by 80% compared with last year. The main reason for the increase in scale is the investment in several large factories. Including: SMIC, Changxin, Yangtze River Storage, etc., as well as other emerging small and medium-sized wafer factory investments. In 2023, the scale of investment will have the opportunity to reach a considerable peak.

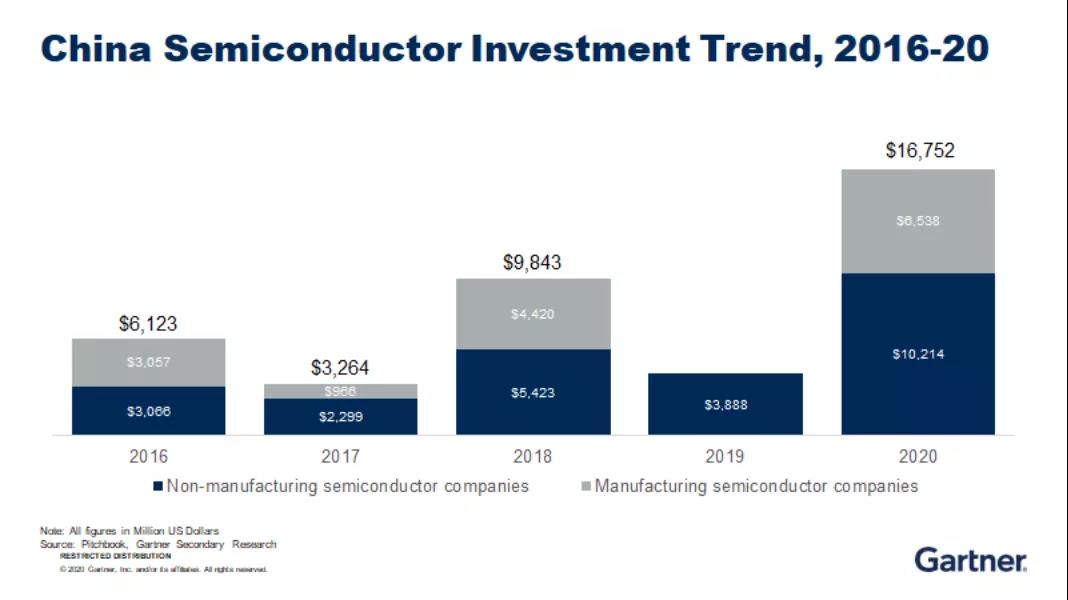

The data in the figure below is based on the investment scale of Chinese semiconductor companies and related companies compiled by sources such as Pitchbook.

The data can be divided into two parts: One is non-production semiconductor companies. The second is production-oriented semiconductor companies. In the past two years, the financing of "non-production semiconductor companies" has been greatly improved. Gartner sees that the scale of investment in some GPUs, autonomous driving, and third-generation semiconductors is also gradually increasing. In addition, large companies such as Huawei, Xiaomi, Intel, Qualcomm, and Samsung are actively investing in China.

For production enterprises, large scale and ups and downs also exist. Judging from the public information collected, the number of investments has increased greatly, and the number of "investment cases" has tripled in the past five years.

Why will there be such a big increase in 2020? One of the main reasons is the emergence of the Sci-tech Innovation Board. The Sci-tech Innovation Board drove the entire investment boom. Originally, the semiconductor investment cycle was long and the return on investment was slow, but the science and technology innovation board provided investors with the motivation to invest in semiconductors and a channel for profitable exit. Capital entering semiconductors is also conducive to helping the industry expand its scale and assisting emerging companies in product innovation.

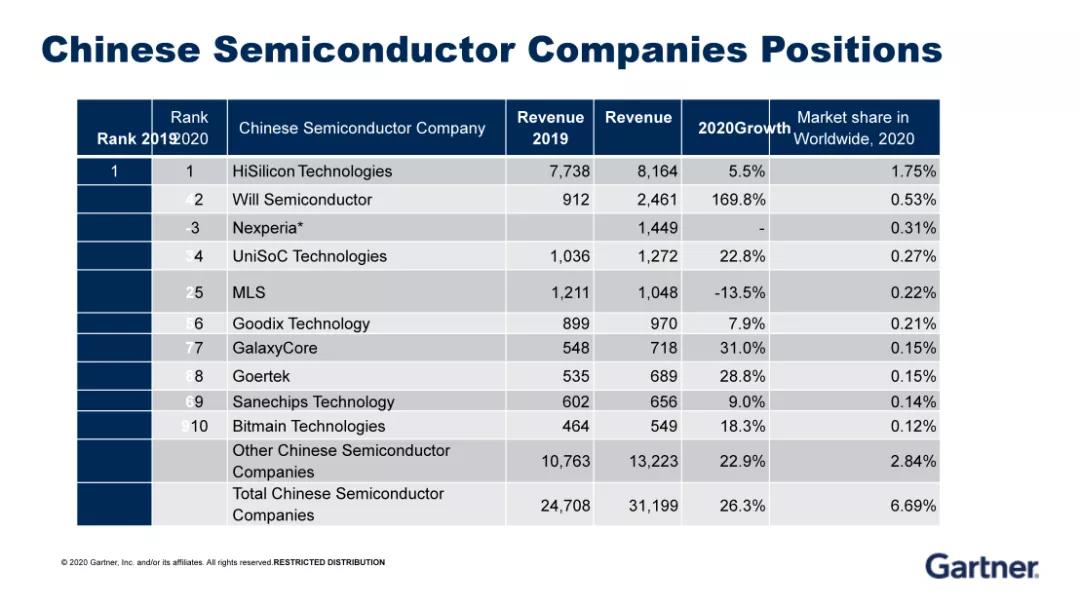

In the top ten of Chinese semiconductor companies, after HiSilicon’s abdication, who will fight for the first place?

Judging from the ranking of Chinese semiconductor companies, HiSilicon is far ahead. However, HiSilicon, under the influence of US sanctions, may experience an avalanche landslide in 2021. So, which companies have the potential to replace HiSilicon’s position next?

According to Sheng Linghai's analysis, the products of Weil Semiconductor and Nexperia, ranked second and third, are relatively single. ZTE Microelectronics, ranked fourth, had revenue of more than 800 million U.S. dollars last year, and its valuation was low. In addition, Goodix Goodix and GalaxyCore Gekewei also have certain potential.

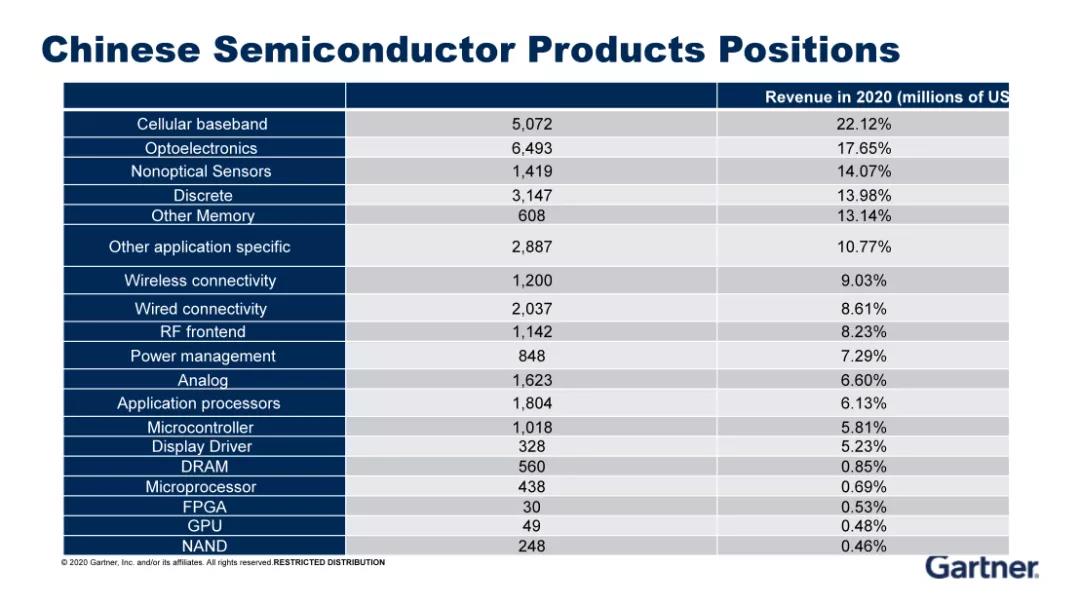

In general, compared to ten years ago, the annual revenue of more than 100 million US dollars can enter the top ten list, and now the annual revenue threshold has reached about 500 million US dollars. This also reflects the rapid growth of domestic semiconductor companies, although the overall global market share only accounts for 6.7%. From the perspective of product breakdown, the weaker types of domestic chips are mainly microcontrollers, display driver chips, as well as DRAM, microprocessors, FPGAs, GPUs, and NAND Flash. In two years, China has the opportunity to increase the proportion of products with lagging shares to more than 5%.

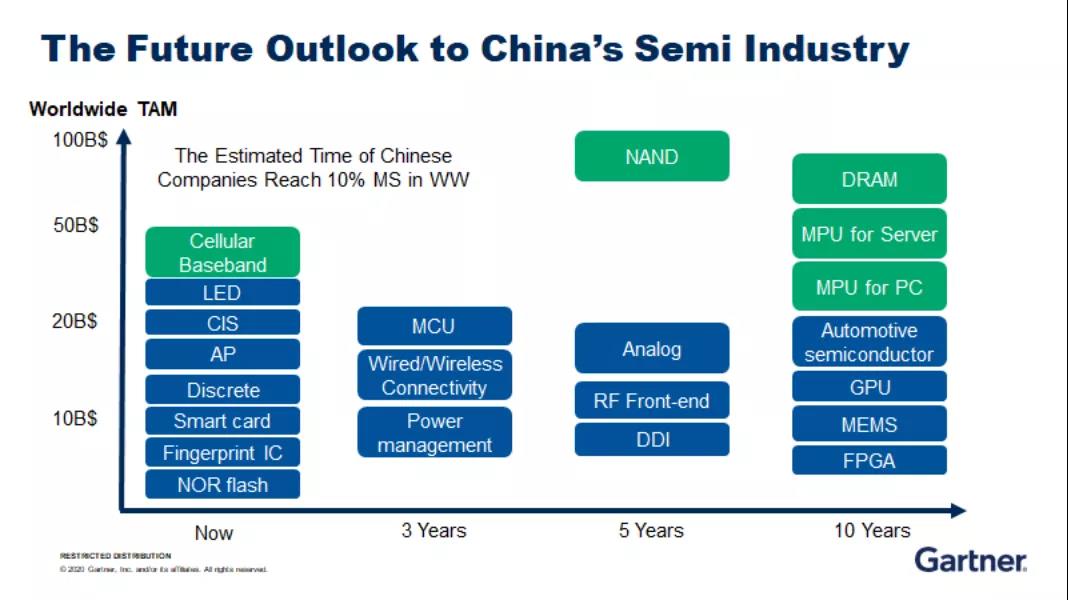

The following figure predicts the market where Chinese chips account for 10% of the global market. Green represents a large-scale and very important product. It can be seen that products with a market share of less than 10% within 10 years include: DRAM, Server, PC, Automotive semiconductor, GPU, MEMS, FPGA, etc.

Building a factory and expanding production is of great significance, but it does not lie in the difference of 8 SMIC

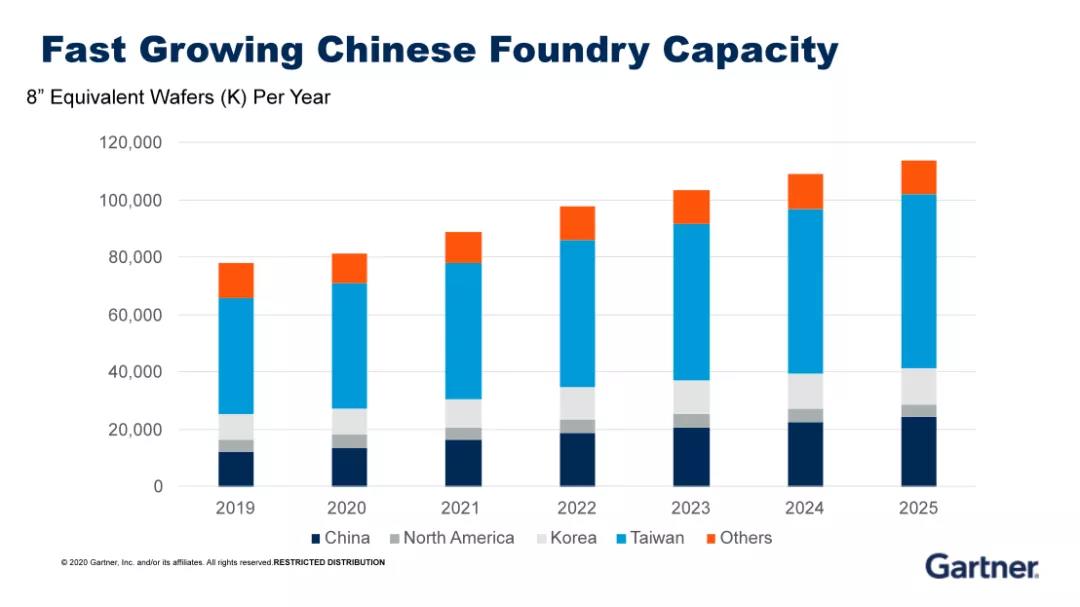

From the perspective of the global foundry market share, China's foundry has grown strongly, and will almost double by 2022 compared with 2019. Taiwan of China still holds the largest market share. North America and South Korea are also expanding their local semiconductor production capacity.

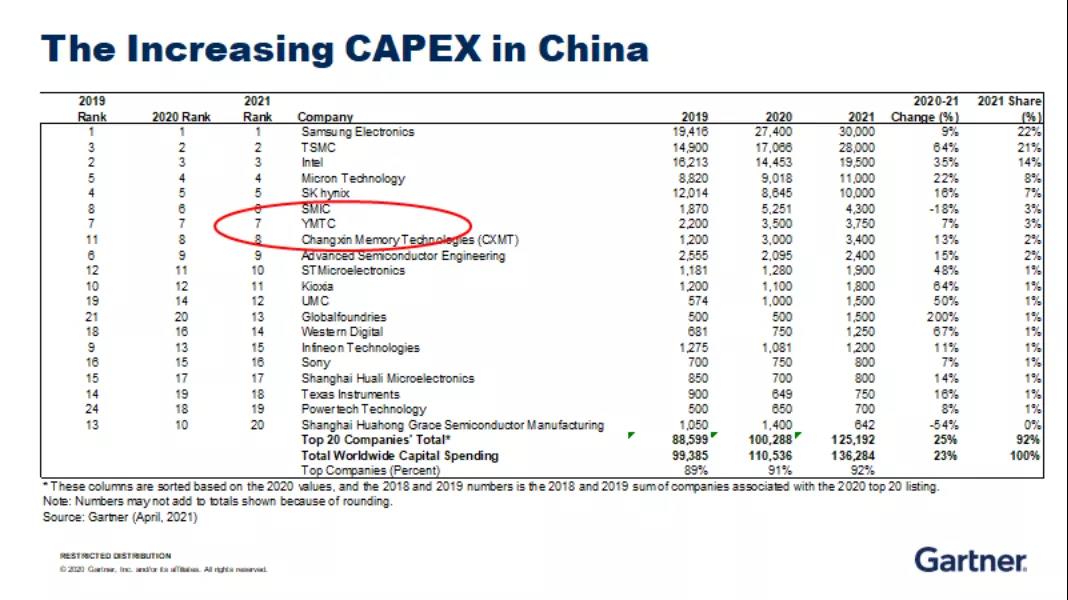

For future investment forecasts, there are three Chinese companies among the top ten, namely SMIC, Yangtze River Storage, and Changxin Storage, which ranked 6-8. However, there is still a big gap in the amount of these three major production enterprises compared with the top five.

It can be seen that the share of Chinese semiconductors in the world is still very small, so it is necessary for China to make large-scale investment in building factories and expanding production.

There was a saying before that "China's chip production gap is still eight SMIC". In this regard, Sheng Linghai said that this statement may be for the public to better understand the current situation of China's semiconductors with more factories and more production expansion. However, he believes that China’s demand for semiconductors continues to increase, and the premise for domestic plant expansion should be whether the products are competitive and what processes are covered. In the past few years, fabs have been reluctant to expand production because of insufficient demand, or Lack of competitiveness. Nowadays, to develop the domestic supply chain, it is necessary to build factories efficiently and planned on a larger level. For example, which types of chips are most in short supply, which types of products are more competitive, and are built toward the goal of becoming the world's number one. It is more meaningful to build factories and expand production.

After the expansion, the inevitable overcapacity situation

When asked by the electronic enthusiast network, the current semiconductor capacity investment and production investment will probably be opened in 2022 and 2023. Based on the continuous production of production capacity, including China, Taiwan, the United States, etc., plants are being built and expanded. Will it eventually lead to overcapacity?

Sheng Linghai said that there will be overcapacity problems, but this is actually a normal cycle. The semiconductor cycle changes every two to three years, precisely because everyone invests when there is a shortage of chips, which brings about oversupply of production capacity in two or three years. If there are no new products, such as 5G mobile phones and other products with high demand, there will be overcapacity. At this time, everyone will be relatively conservative. After another two to three years, new products will appear to drive new demand.

Therefore, current investment will cause oversupply in 2023 and 2024 in the future. However, there may be situations in which some manufacturers are still in short supply due to their good products, but other manufacturers are in a state of oversupply. In a market, we cannot assert that supply and demand are perfectly matched. Basically, it will constantly oscillate on the upper and lower sides of the overall balance. Even if there is an oversupply situation, some well-planned companies, such as TSMC, will still maintain their own competitiveness in the market.

What kind of chip is the last mitigation?

Regarding the current shortage of chips, Sheng Linghai said that the most serious problem at present is the power supply chip, and the power supply and analog chips are affected by the shortage of 8-inch line production. The shortage of the mobile phone industry has improved, because the demand for mobile phones has not reached the expected value. The stock-out situation in the TV market has also improved. The price increase has reduced consumers' desire to buy to a certain extent. It is estimated that the market is still in the peak season in the second half of this year, and the first and second quarters of next year, especially the second quarter, will enter the traditional off-season. By then, new production capacity will increase this year, and the shortage of chips can be alleviated.

However, the shortage of power chips will continue for some time, mainly due to the 8-inch investment and the process of 12-inch transfer. Its shortage is expected to continue into the second half of next year. But on the whole, Gartner predicts that the second quarter of next year may not be such a severe shortage.